2026 Indonesia Compliance New Deal Panoramic Interpretation: A Survival and Growth Guide for B2B Brands

Compliance Countdown! Indonesia's Market Usheres in the "Strictest Ever" Regulatory Reform

As Southeast Asia's largest population and a core e-cigarette market with enormous consumption potential, Indonesia is undergoing a fundamental transformation from "loose regulation" to a "standard + license" system. The previous market environment lacking unified norms is coming to an end, replaced by a mandatory compliance system covering the entire chain of R&D, production, and circulation.

For B2B brands deploying in Indonesia, key timelines have been clarified: on July 26, 2026, BPOM Regulation No. 18 of 2025 will come into full effect. The 12-month transition period is not only a "buffer period" for compliance rectification but also a "critical window" for brands to retain their presence in the Indonesian market. Only by seizing this golden period to complete compliance layout can brands gain a firm foothold amid the wave of increasing market concentration and seize subsequent growth opportunities.

This article will deeply dissect the core requirements of Indonesia's new e-cigarette compliance policies, accurately compare differences between old and new regulations, predict risks of unresolved policies, and provide actionable compliance paths for B2B brands, helping them seize opportunities and achieve risk-controllable market growth amid regulatory changes.

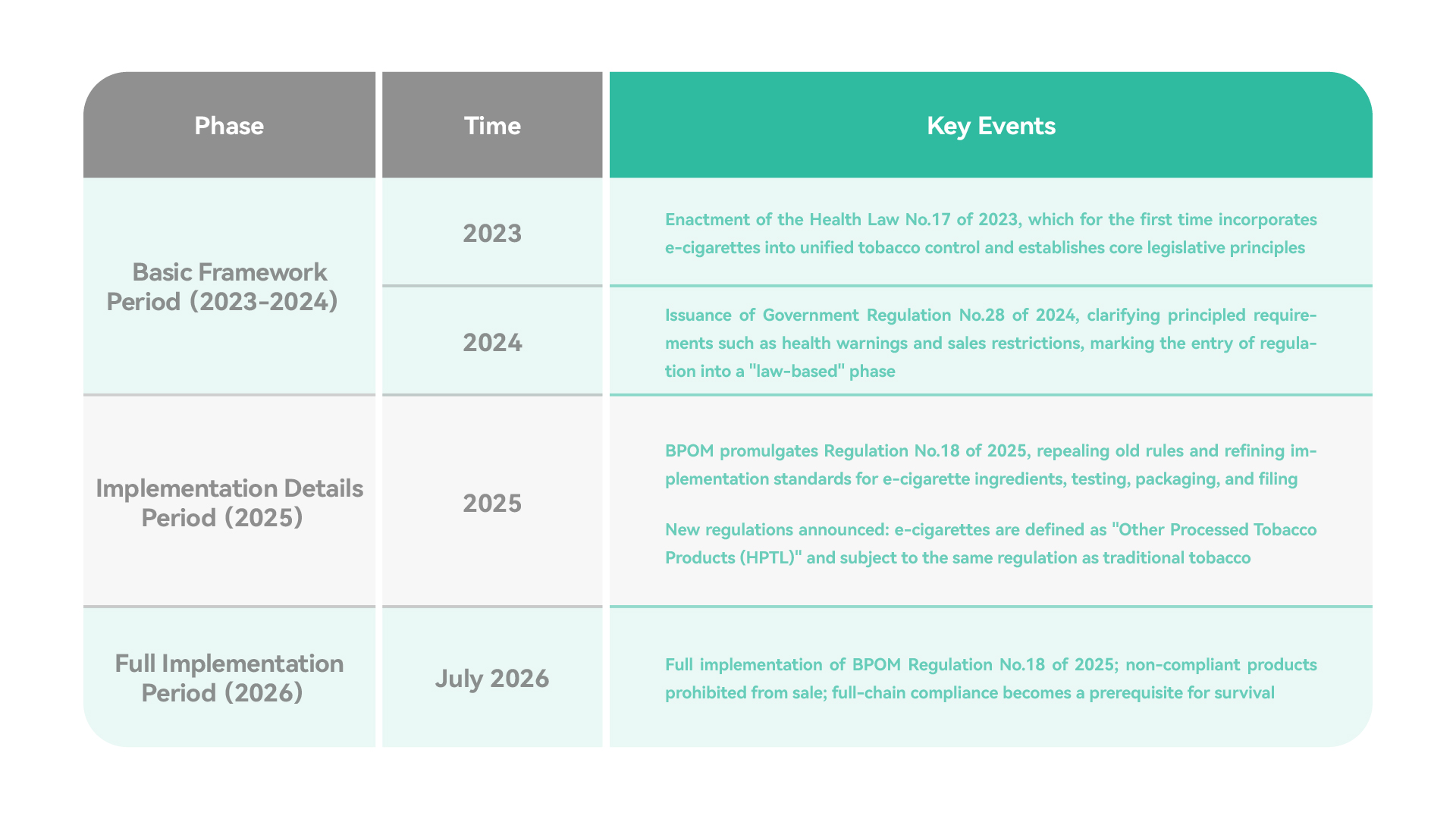

I. Panoramic Timeline of Indonesia's E-Cigarette Compliance Regulations

II. In-Depth Interpretation of the Latest Core Regulations

1.Core Regulatory Documents

The core basis for this compliance reform lies in two official documents: BPOM Regulation No. 18 of 2025 (implementation details) and Government Regulation No. 28 of 2024 (principled requirements). Together, they form a "double guarantee" for e-cigarette compliance in Indonesia, covering the entire process from product R&D to terminal sales.

2.Four Core Compliance Pillars

(1)Ingredients and Testing: Scientific Control with Dual Verification

Regulatory Requirements: Prohibit additives without "scientific proof of harmlessness". Pre-market additive testing and in-market additive verification must be conducted in separate certified laboratories.

Brand Response: Review existing formulas to eliminate non-compliant additives and ensure nicotine content meets standards; proactively cooperate with two laboratories to complete testing and retain reports to avoid rework.

Our Support: Provide compliant formula customization and optimization services to avoid prohibited ingredients; assist in connecting with BPOM-recognized local laboratories in Indonesia and offer dual testing services to ensure rapid report approval.

(2)Packaging and Labeling: Enhanced Warnings and Transparent Information

Regulatory Requirements: 50% of both front and back packaging surfaces must display color graphic-text warnings (5 sets for rotation); mandatory labeling of "contains nicotine" and "not for sale to persons under 21 or pregnant women" with no misleading statements.

Brand Response: Design 5 sets of warning graphics in accordance with standards and entrust local institutions to avoid cultural risks; verify each labeled item one by one and reserve space for tax stickers.

Our Support: Provide 5 sets of compliant warning graphic design templates (aligning with medical standards and local aesthetics); arrange compliance specialists to conduct full-process reviews of packaging designs to ensure complete and compliant labeling information.

(3)Market Entry Filing: Pre-review and Standardized Processes

Regulatory Requirements: New variants and changes to formulas, packaging, or manufacturers must submit materials to BPOM in advance. Completeness review takes 7 working days; products with incomplete materials are prohibited from being listed.

Brand Response: Streamline SKUs based on the definition of "variants" and merge similar product lines; reserve a buffer period of over 3 months for filing to ensure complete materials.

Our Support: Assist in organizing filing materials, track BPOM review progress with partners, provide timely feedback on revisions, and shorten the filing cycle.

(4)Channels and Qualifications: Qualifications First with Regional Restrictions

Regulatory Requirements: Must obtain API-U import license + SNI certification; offline stores must be 200 meters away from campuses; online sales require age verification for customers over 21; social media advertising is prohibited.

Brand Response: Prioritize qualification applications and entrust local agents to accelerate processing; inspect offline stores and cooperate with e-commerce platforms to upgrade age verification systems.

Our Support: Provide consultation and coordination services for qualification applications, including reference materials, timelines, and costs; offer local production lines to minimize compliance impacts; share the list of BPOM-recognized laboratories to help brands lock in cooperative resources in advance.

(5)Taxes, Fees, and Pricing: Cost Pass-Through and Compliant Pricing

Regulatory Requirements: New minimum retail prices + consumption taxes implemented from 2025, with annual increases of 15% over the next five years; e-liquids must be affixed with tax stickers.

Brand Response: Plan pricing strategies in advance to balance compliance costs and market competitiveness.

Our Support: Track updates to tax and fee policies in real time, provide product pricing recommendations, and assist brands in optimizing cost structures.

III. Key Differences Between Old and New Regulations

The core difference lies in the new regulations' logic of "full-category coverage, full-process control, and strict standard enforcement", which completely addresses the old regulations' issues of "regulatory gaps" and "vague standards", significantly raising compliance thresholds.

IV. Predictions on Pending/Uncertain Matters

Although core regulations are clear, some supporting details are still being formulated:

1.Technical Standards: Details such as the list of BPOM-recognized laboratories, testing standards, and limits for nicotine and synthetic nicotine have not been refined.

2.Policy Implementation: Unified national rules for smoke-free areas and supervision measures for single-unit sales bans are not yet clear.

3.Taxes, Fees, and Customs Clearance: Details of consumption tax increases, processes for designated customs clearance airports, and inspection standards have not been fully disclosed.

4.Packaging Specifications: Details such as unified color standards for e-cigarette packaging and update cycles for warning graphics currently lack the latest official guidance. Although there is Ministry of Health Regulation No. 56 of 2017 on packaging, this is a "revised rule" for traditional cigarette packaging in Indonesia, not a dedicated e-cigarette packaging regulation. Early e-cigarettes were not explicitly included in this regulation and only indirectly referenced some general requirements due to classification, lacking targeting.

Our Support: Establish a dedicated compliance policy tracking team with local Indonesian legal professionals to synchronize official updates in real time, provide interpretations and response suggestions, and assist brands in quickly adjusting plans to avoid potential risks.

The regulatory transformation of Indonesia's e-cigarette market, while seemingly raising entry barriers, is an inevitable trend toward market maturity and standardization. According to industry media predictions, after the implementation of the new deal, market concentration will significantly increase, and compliant brands will usher in broader growth space.

Zinwi sincerely invites partners to join hands with us. Leveraging our compliance experience, local resources, and full-process empowerment support, we can seize opportunities amid regulatory changes, jointly open up the path to compliance in Indonesia, and achieve long-term growth with controllable risks.

We will contact you as soon as possible